Key Concepts

www.investopedia.com is a great resource if you have questions about terminology in your company plan. Some of the information in this document is copied from investopedia.

Inflation

- DEFINITION – The rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Central banks attempt to stop severe inflation, along with severe deflation, in an attempt to keep the excessive growth of prices to a minimum. As inflation rises, every dollar will buy a smaller percentage of a good. For example, if the inflation rate is 2%, then a $1 pack of gum will cost $1.02 in a year. Most countries’ central banks will try to sustain an inflation rate of 2-3%.

- If you don’t invest (and grow) your money, your savings will buy less every year.

- Your investments need to, at a minimum, grow as much as the rate of inflation. This is sometimes referred to as a “hedge” against inflation. “Hedge” just like a fence or a boundary or a guard.

Basic Mathematical Concepts

- Rule of 72 – Investments or costs double based on the rule of 72.

- 72 divided by the projected annual interest rate = the number of years required for the investment to double in value.

- Assuming a 7.2% annualized return on an investment, it will double in value every 10 years.

- Assuming a 3% rate of inflation, the cost of everything will double every 24 years. (72/3=24). Expect the cost of living to be at least double what it is today when you finally retire.

Assets

- Things you invest in are your assets.

- Assets are things that appreciate (grow in value). Your home is an asset. Most of the things inside your home aren’t.

- Your Assets are typically divided into 4 categories (Asset Classes)

- Cash

- Real Estate

- Stocks

- Bonds

Cash

- It is good to have some cash on hand for monthly expenses and emergencies.

- Do you have enough cash to pay the rent while you are between jobs?

- Do you have enough cash to cover a vehicle breakdown or a wreck?

- Do you have enough case to purchase Assets if they are available at a bargain price?

- It is bad to have too much cash on hand because Inflation makes it worth less over time.

Real Estate

- Over the long haul, real estate investments (your home) grow at a rate of about 6% – 7% / year. This makes real estate a good way to hedge (guard) against inflation.

- Unfortunately, there are a lot of costs of residential real estate that eat into your 6% to 7% return

- significant transactions costs

- closing costs

- property taxes

- maintenance and improvement costs.

- The return on investment for a homeowner should also consider the imputed rental income (meaning the money you save by owning instead of renting), net of all costs. A study covering the period 1952-2005 found that when costs and imputed rental income were included, the real return to homeowners was 6.9 percent, comparable to the 7.3 percent real return for the S&P 500.

- You have to live somewhere, so you would have some of these costs anyway.

- This makes real estate a good investment for your personal home but not for the remainder of your assets.

- Unfortunately, there are a lot of costs of residential real estate that eat into your 6% to 7% return

Stocks (a.k.a. Equities)

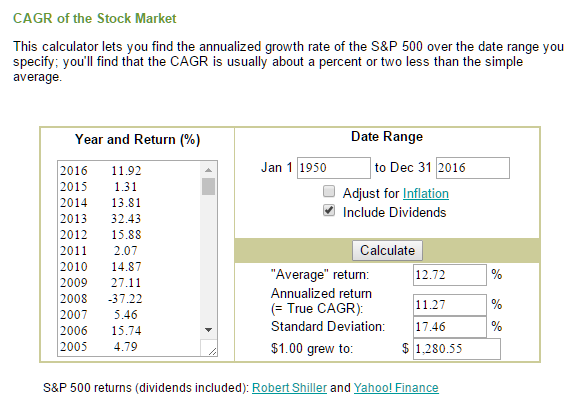

- Equities have returned an average of about 11% to 12% per year since 1950.

- See the note at the bottom of the chart that shows a $1 investment in 1950 growing to $1,129.27 in 2014.

- Equities are risky over the short term. You could lose a significant portion of your investment in any given year. See the 37.22% downturn (loss) in 2008 on the following chart.

Bonds

- When companies or other entities (public utilities and government entities) need to raise money to finance new projects, maintain ongoing operations, or refinance existing other debts, they may issue bonds directly to investors instead of obtaining loans from a bank.

- Large companies and government entities typically repay their debts so Bonds are considered a low risk investment.

- Note: Several large cities have declared bankruptcy in recent years. This goes against the assumption of low risk.

- A federal judge recently approved Detroit’s plan to pay off about $7 billion in debt. Detroit previously became the largest U.S. city ever to file for bankruptcy in 2013.

- Overall bankrupt municipalities remain extremely rare. A Governing analysis estimated only one of every 1,668 eligible general-purpose local governments (0.06 percent) filed for bankruptcy protection from 2008 through 2012. Excluding filings later dismissed, only one of every 2,710 eligible localities (not all states permit governments to file for bankruptcy) filed since 2008.

- You can make money in Bonds in two ways

- You can collect the interest paid by the company issuing the bonds.

- You can sell you bond to another investor who wants to collect the interest.

- If the bond pays a higher interest rate than investors can find other places, they will happily pay you a premium for your bond and you make money selling it. This typically happens when you buy a bond during a time of high interest rates and sell it after interest rates drop.

- You can lose money in Bonds in two ways

- The entity issuing the Bonds could fail to repay due to bankruptcy or other issues.

- Your Bond could lose value because investors can find Bonds that pay better on the open market. This typically happens when you buy a bond during a time of low interest rates and sell it after interest rates rise.

- In summary

- Bonds are typically lower risk investments than Equities so the return (earnings) to the investor does not need to be as high as Equity (stock).

- Bonds are typically a pretty good investment when interest rates are high and they are typically a bad investment when interest rates are low.

Bond Proxies:

You need to avoid buying bonds when interest rates are low and going up. During this time, you need to replace bonds in your portfolio with something that is low risk but has a chance of earning a modest gain. We can replace bonds with low risk, blue-chip, high dividend stocks like AT&T, Verizon, etc. Replacing bonds with other investments in your portfolio is referred to as a “bond proxy.”

ETFs – Exchange Traded Funds

- ETFs are a fairly recent option for investors (past 15 years).

- ETFs are investments in a larger fund that buys and sells multiple Assets and groups their overall return into one Asset you can purchase.

- For example: There are ETFs that purchase stocks in the same proportions as the stocks that make up the S&P 500.

- If you tried to do that, you would have to purchase 502 different stocks.

- Or you could just purchase an S&P 500 ETF like IVV or SPY.

- For example: There are ETFs that purchase stocks in the same proportions as the stocks that make up the S&P 500.

- Another example is an ETF that purchase a broad section of Japanese Stocks or other foreign stocks. Your return for this ETF would mimic the overall market of that country’s stock market.

Fees

- It costs money to buy stocks and bonds. No company will manage your investment for free.

- You need to pay attention to the fees you are charged for investing in each asset.

- Stocks have a transaction fee when you buy and sell them.

- ETFs have loadings

- High fees will drag down your investment performance and they rarely pay for themselves. Shop around for the cheapest loadings and fees on any investment.

Currency Exchange Rates

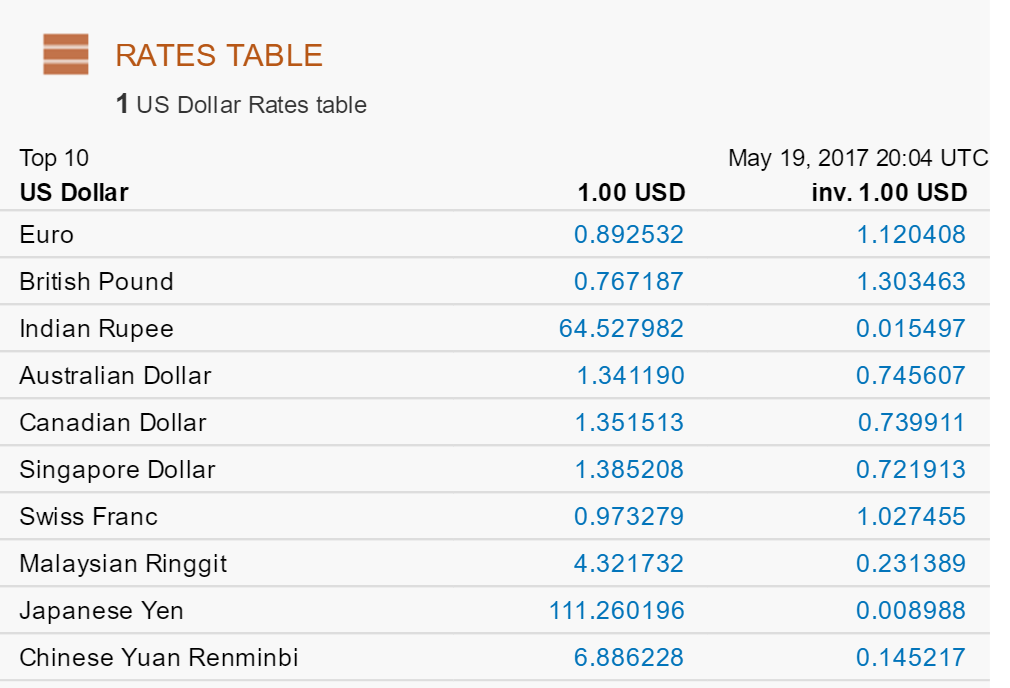

- On any given day, the U.S. dollar has a different value vs. other country’s currency.

- So…If you buy stock in a British Company that is traded on the FTSE (Great Britain stock market), it costs you about $1.30 for every British Pound that stock is priced at (in 2014 it was $1.56).

- If the price on the FTSE remains unchanged but the U.S. dollar becomes stronger (fewer dollars required per British Pound), you LOSE money.

- You sell your stock in British Pounds but they pay you fewer dollars in exchange.

- If the price on the FTSE remains unchanged but the U.S. dollar becomes weaker (more dollars required per British Pound), you GAIN money.

- You sell your stock in British Pounds but they pay you more dollars in exchange.

- If the price on the FTSE remains unchanged but the U.S. dollar becomes stronger (fewer dollars required per British Pound), you LOSE money.

- Also, exchange rates can affect the earnings of U.S. Assets and push their stock prices up or down.

- The U.S. recovered faster from the 2008 economic recession which made the U.S. dollar stronger against many foreign currencies (It took less dollars to buy a foreign dollar/real/peso/euro)

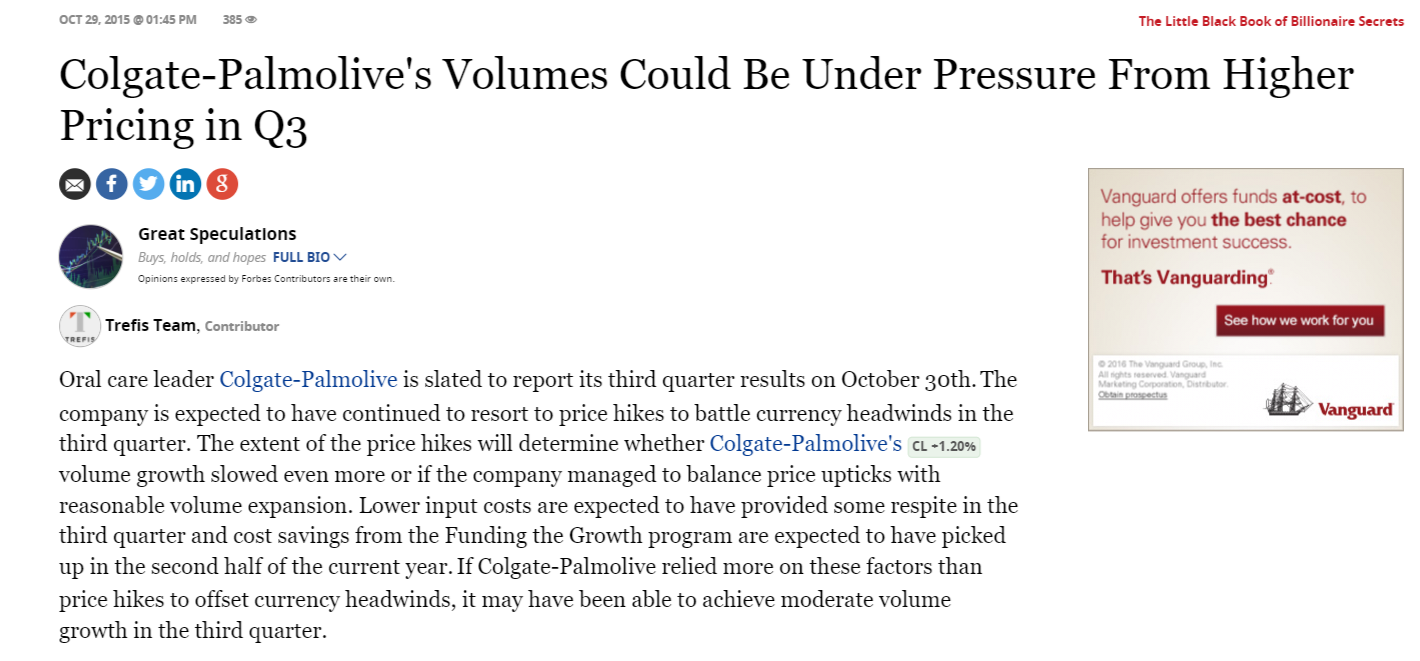

- Colgate sells staple goods on the international market. Business is booming and growing year over year.

- Unfortunately, Colgate gets fewer dollars for each bar of soap they sell in a foreign country

- Because they really can’t just raise the price, in pesos, for a bar of soap in Mexico or they might lose market share.

- When they convert the pesos back to U.S. dollars, they get fewer dollars in return. This hurts earnings and the stock price stagnates or drops.

- NOTE: If the dollar is very strong and you think it will probably get weaker as other countries get stronger, you might consider buying stock in a company like Colgate.

- As the dollar gets weaker, the same bar of soap pays more dollars per peso and helps the company’s earnings and their stock price.

How Much Will You Need to Retire (the calculation isn’t that hard)

- If you are in your early 20s and you expect to retire in your early 60s, you have 40 years to work.

- Assume there will be no pension and no Social Security for your generation.

- Based on the Rule of 72, above, inflation will make the cost of living rise to 3 times what it is today.

- If gas is $2.50 per gallon, it will be $7.50 per gallon when you retire.

- For example, if you think you can live like a king on $100,000 / yr. (before taxes) today.

- $100,000 per year before taxes is about $5400 / mo. in spending money after taxes.

- Because of inflation, you will actually need $300,000 / yr. in retirement (to be like $100,000 today).

- You don’t want to have less spending power every year in retirement so you need to give yourself a 3% cost of living raise per year in retirement to keep up with inflation.

- Year 1, you need $300,000

- Year 2, you need $309,000

- Year 3, you need $318,270

- etc.

- Assume you can make about 7% per year on your assets.

- Assume you don’t know how long you might live so you don’t want to draw down the principal.

- If you are making 7% but you need everything to grow by 3% each year to cover inflation, you can only take out 4% of your Assets per year without touching the underlying value of your portfolio.

- 4% needs to get you $300,000 in the first year. $7,500,000 x .04 = $300,000.

- You will need $7.5 million dollars saved before you can retire.

- Maybe a little less because of slower future inflation and your ability to spend some of the principal later in life.

- Also, you will save a little in taxes in retirement because you won’t pay FICA tax (Medicare plus Social Security).

- You can change the numbers and do your own calculations.

How Much Should You Be Saving

- If your company has a 401(k) match, you need to save a minimum of enough to get the full match.

- For example, they match 50% of the first 6% of your salary; you need to save 6% to get all the free matching money.

- In addition, you need to work up to a point where you are saving approximately 20% – 25% of your current income.

- It really does not matter if you save before tax or after tax money assuming your tax brackets won’t change dramatically between now and when you retire.

- There are some caveats to this rule with respect to Required Minimum Distributions (RMDs), retiring before 59.5 years of age, and leaving money to your children. (All good problems to have)

- Most people save before taxes and this is as good a strategy as any. You assume you will live on less when you retire but you can predict that the government will raise tax rates in the future.

- It really does not matter if you save before tax or after tax money assuming your tax brackets won’t change dramatically between now and when you retire.

- Assuming

- Current income of about $60,000 / yr.

- 3% annual raises throughout your employment (at least enough to keep up with inflation)

- Retirement in 40 years

- 7% annual return on your assets

- 3% annual inflation

- $7.5 million to retire

- 20% plus 3% employer match = $4,252,800

- 25% plus 3% employer match = $5,177,322

- 30% plus 3% employer match = $6,101,844

- All this plus a little help from a working spouse can get you there (and maybe in less than 40 years).

Teamwork in Action

- You don’t have to bear the burden alone. If you and your spouse work together toward retirement, it gets a lot easier.

- There are a couple of ways to approach this:

- You and your spouse can both save a healthy portion of your salaries.

- You can use one spouse’s income for expenses and save the majority of the other spouse’s income.

- In the example, above, let’s assume that both spouses start out making $60,000 / yr.

- We make the same assumptions of 3% annual raises, 40 years to retirement, 7% earnings, and 3% inflation:

- 15% plus 3% employer match = $6,656,557

- 20% plus 3% employer match = $8,505,601

- 25% plus 3% employer match = $10,354,644 (or $4,993,223 if you retire early after 30 years)

- 30% plus 3% employer match = $12,203,688 (or $5,884,871 if you retire early after 30 years)

What is a Portfolio?

According to Investopedia.com, “A portfolio is a grouping of financial assets such as stocks, bonds and cash equivalents, as well as their funds counterparts, including mutual, exchange-traded and closed funds. Portfolios are held directly by investors and/or managed by financial professionals. Prudence suggests that investors should construct an investment portfolio in accordance with risk tolerance and investing objectives.”

Choosing an Investment Mix for your Portfolio

Nobody can predict the future but we can study the past performance of various investment mixes. We can ascertain things like:

- How much would the portfolio have made, on average, over an extended period of time?

- What was the maximum single year loss of the portfolio?

- We care if we need to access the money soon and we don’t have time to wait for the portfolio to recover from a large loss.

- Was the increased performance worth the increased risk over other investment mixes.

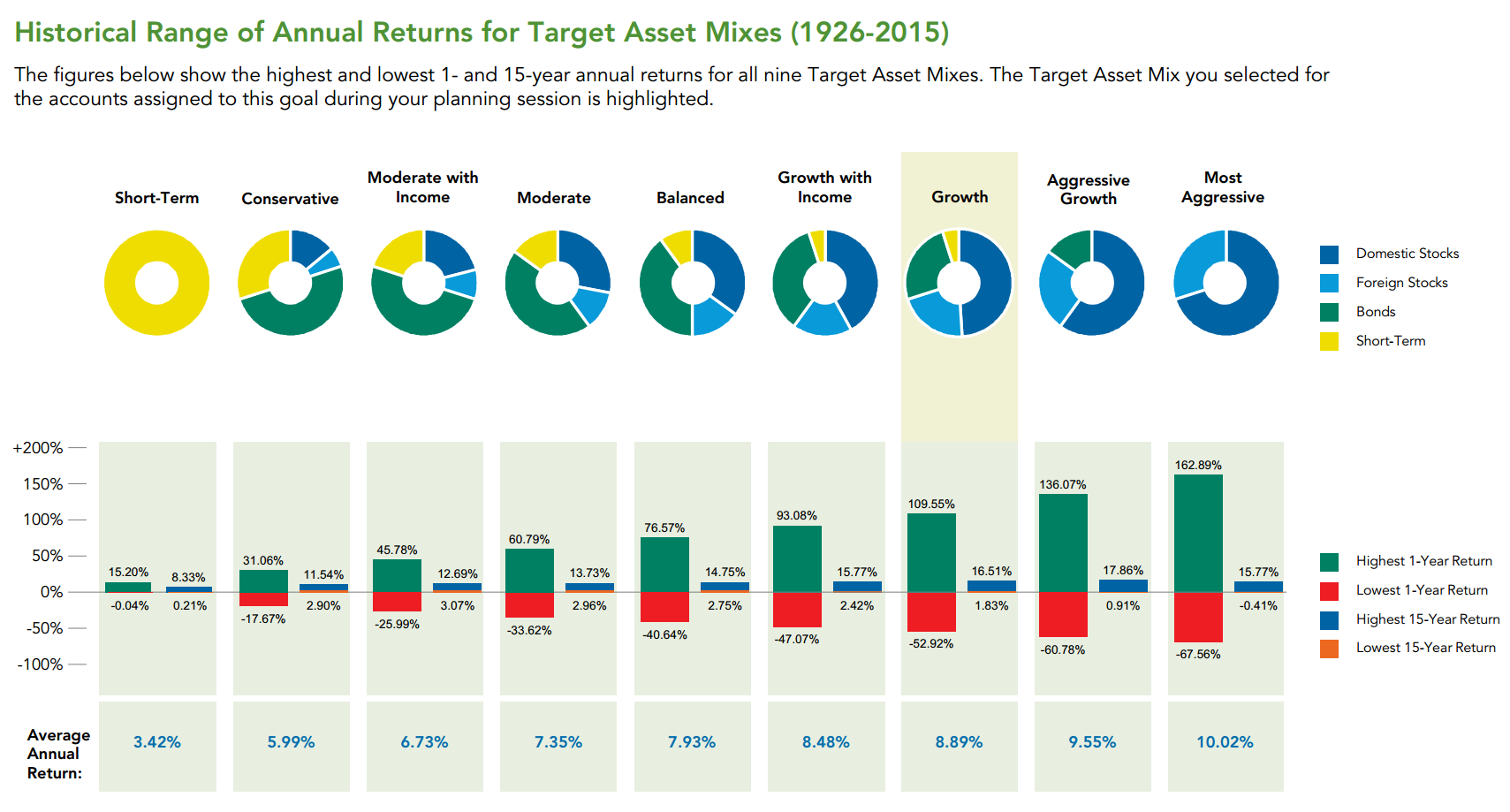

Fidelity Investments has a great graphic that depicts the historical value of various investment mixes:

The first portfolio is labeled “Short Term”. It consists of all money in cash in a money market account earning bank account like interest. Most of the time, this type of account will just keep up with inflation but there is almost zero risk that you will lose your money.

As we read from left to right, the amount of cash in the portfolio gets smaller and is replaced with investments starting with bonds (low risk) and accelerating toward stocks (higher risk).

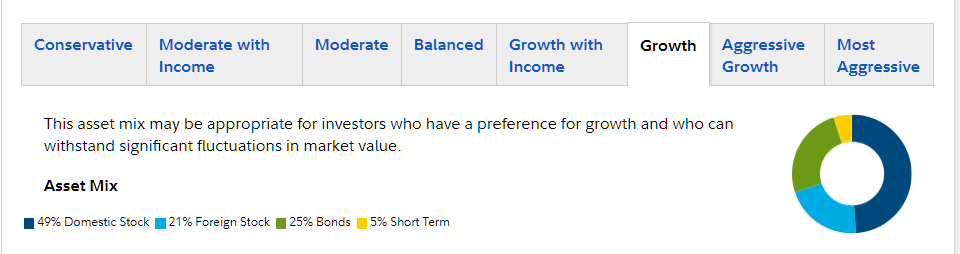

If you don’t need to tap into the money in the near term, the Growth Portfolio gets a good return with a low downside risk.

The Growth Portfolio is made from the following asset mix:

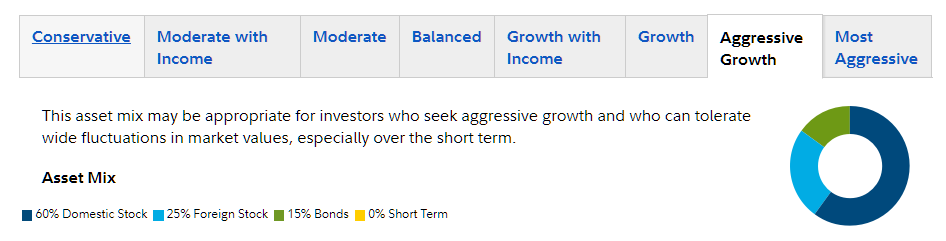

If you don’t need any cash in your portfolio because you don’t intend to withdraw any money in the near future, you could use the Aggressive Portfolio mix.

Rebalancing your Portfolio

You need to invest money in your portfolio based on your chosen investment mix. Over time, portions of your investments will earn more than others and cause your investment mix to become out of balance. You need to re-balance your portfolio once per year to get your investment percentages back in line with your chosen portfolio mix. For example, if you choose an investment mix of 60% domestic stocks, 25% foreign stocks and 15% bonds and foreign stocks grow faster one year than the other categories, you need to sell some foreign stocks and buy either bonds or domestic stocks to get your portfolio back into balance at 60%/25%/15%.

Building a Portfolio (with the options your employer gives you)

Adam’s 401(k) options

Adam had several different options to choose from but they fall into three basic categories:

- Stocks (equities)

- Risky

- Higher Return

- Bonds

- Less Risky

- Lower Returns

- Blended Portfolios (a mix of stocks and bonds)

Adam’s Option A – Target Date Series

- This contains a higher percentage of stocks than bonds when you are young (more risk) and vice versa when you are old (less risk).

- Target Retirement 2015 means, “I intend to retire this year.” Higher % of Bonds = Lower Risk

- Target Retirement 2055 means, “I intend to retire in 40 years.” Higher % of Stocks = Higher Risk.

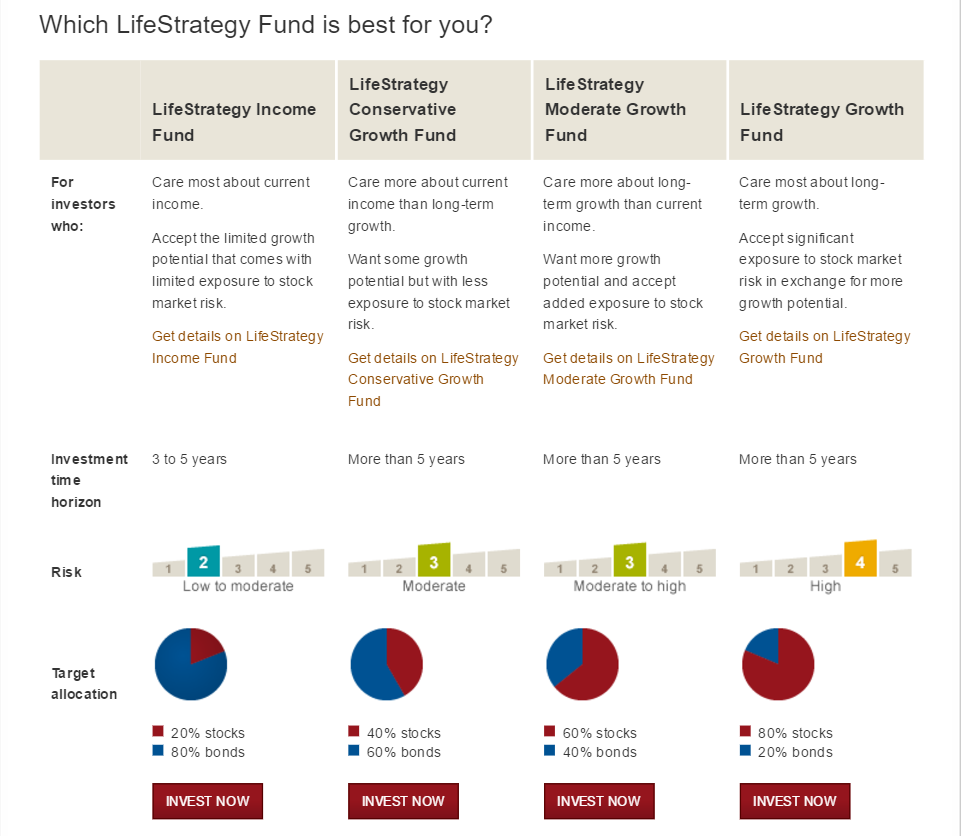

Adam’s Option B – Asset Allocation Series

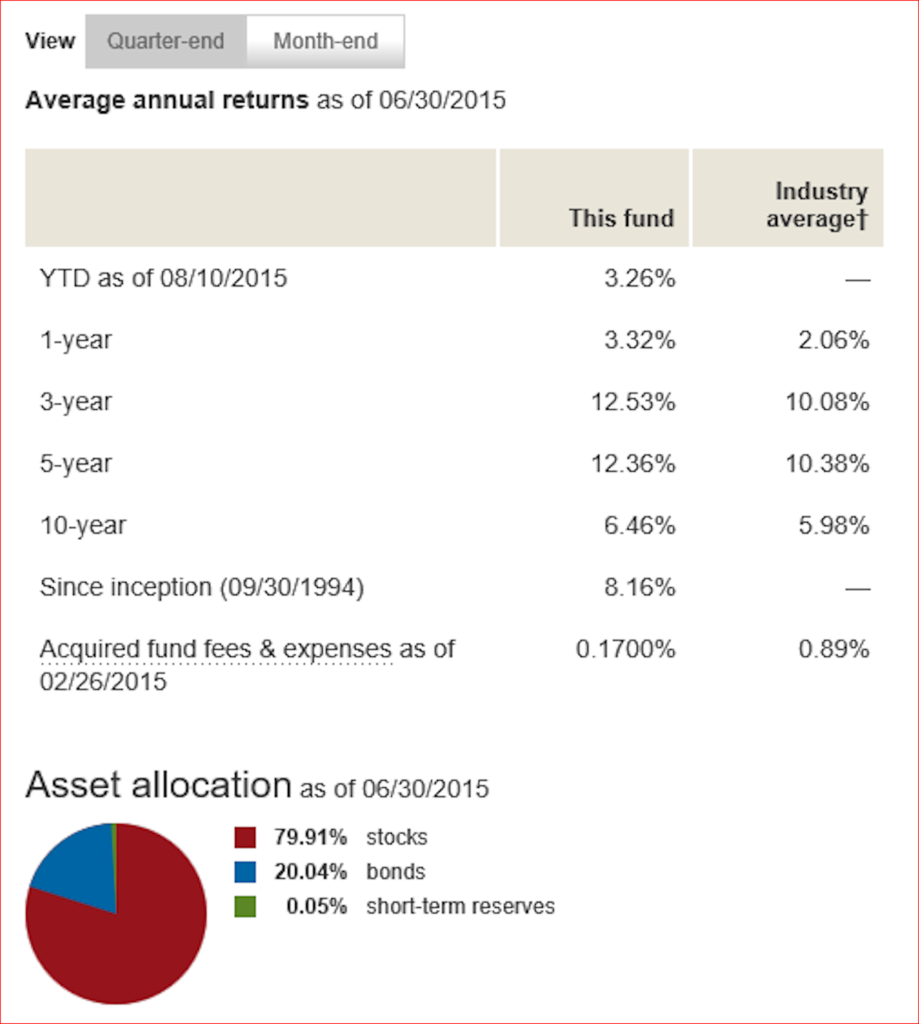

- This is straight off the Vanguard LifeStrategy web page:

- You get to pick your appetite for risk regardless of your age.

- For the LifeStrategy Growth Fund (the most aggressive they offer):

- Summary – The Growth Fund seeks to provide capital appreciation and some current income. The fund holds 80% of its assets in stocks, a portion of which is allocated to international stocks, and 20% in bonds, a portion of which is allocated to international bonds. In addition to stock market risk, the fund is also subject to currency risk and country risks. Investors with a long-term time horizon who are looking for growth of principal over time and who can accept stock market volatility may wish to consider this fund.

- I read the prospectus and the acquired fund fees & expenses as of 02/26/2015 = 0.1700% (Not GREAT but GOOD).

- My view of this fund’s performance – It is dampened by the fact that they still have 20% bond holdings and bonds have been losing steam for years. As interest rates begin to rise in September, 2015, bonds will continue to be a losing proposition.

Adam’s Option C – Create his own Investment Portfolio

- This is the option we want to choose because of the unique predicament we face due to artificially low interest rates that were enacted to reverse the 2008 recession and their effect on bond prices in the short term.

- Otherwise, we would choose the LifeStrategy Growth portfolio and stick with it for the next 10 years or so before re-evaluating. It would be less work to manage and it would achieve the desired result.

- Our portfolio will look a lot like the LifeStrategy Growth portfolio but we will replace the Bond portion of the portfolio with high dividend paying, blue chip, stocks.

- We don’t want to be foolhardy but we can be pretty aggressive at a young age while we still have our health and a lot of investing years to make up losses.

From Fidelity Investments

- Our Target Asset Allocation will be

- 50% domestic stock (like in an S&P 500 ETF)

- This will be one of the Large Cap Blend ETFs

- Choose the Vanguard Total Stock Market Index (based on reputation and fees).

- 25% foreign stock (another ETF)

- This will be the Oakmark International Ret Acct

- It is beat down in the short term but it usually does pretty well and has a good reputation on Morningstar.

- 25%

BondsBlue Chip Dividend Stocks- This will be a Large Cap Value Stock / ETF

- I guess you should pick the American Funds Washington Mutual Investors Ret Acct (Class: R-5) under Large Cap Value Stocks.

- It isn’t GREAT but it will do.

- 50% domestic stock (like in an S&P 500 ETF)

- Every year or so, go back in and re-balance to these percentages by selling one that is over the target percentage and buying one that is under.

- In 3 to 5 years, let’s re-evaluate the bond strategy.

What about Gold?

Gold is a basic element on the periodic table just like Copper, Platinum, Zinc and Silver.

Gold has been used as a currency since about 700 B.C. In all likelihood, it will always t will probably always be one of the safest currencies in the world. That does not necessarily make it a good investment.

Gold is a commodity and a currency at the same time. All the gold that has ever been mined (about 170,000 metric tons) is still considered “in circulation”. It does not corrode like aluminum or copper. People hoard it in the form of jewelry or ingots but these items eventually come back into circulation. The amount of gold in circulation grows by a little under 2% per year due to additional mining. If the demand for gold stayed constant, gold would decrease in value by 2% per year due to the additional supply being added.

The Gold Standard:

Countries used to exchange gold as a method of payment because it was universally accepted and they really didn’t trust other countries to not artificially manipulate their currencies (sound familiar?) The problem with paying in gold bullion and gold coins was; gold is very heavy and hard to transport. In the mid-1800s, countries fixed this problem by exchanging paper money with a guarantee they would exchange their currency for an equal value of gold. This became known as the “gold standard”.

The United States stopped using the gold standard in 1971. Since 1971, the value of gold has varied greatly.

What Drives the Price of Gold?

Since gold does not deteriorate and it isn’t especially rare, the supply side of the supply and demand equation does not change much unless it is artificially manipulated.

The Supply and Demand Equation:

The price of anything is based on the supply vs. the demand. The supply of gold is basically fixed so there are only two things that can typically happen:

- If the demand increases and the supply remains the same, the price will increase.

- If the demand decreases but the supply remains the same, the price will drop.

Artificial Manipulation of Supply:

When countries tied their currency to gold during the gold standard days, they had to stockpile gold to keep its value from going down. By stockpiling gold and strategically releasing it into the market, countries could control inflation. This was the original purpose of the Federal Reserve Bank. Countries largely stopped this practice after they stopped following the gold standard.

Is gold a good investment?

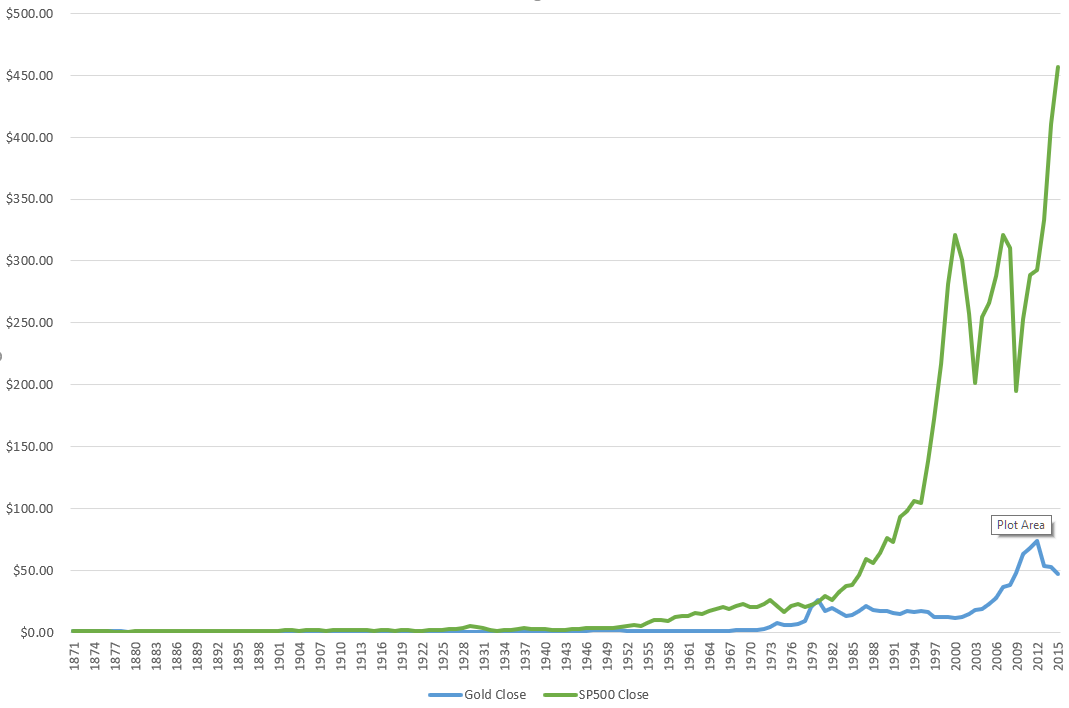

The following chart shows the value of a $1 investment in gold vs. a $1 investment the S&P 500 starting in 1871 and ending in 2015. The $1 gold investment would have grown to $47.11 and the $1 S&P 500 investment would have grown to $456.80.

Is gold a good hedge against inflation?

Between 1980 and 2001, the Consumer Price Index (a good barometer of inflation) went from 82.4 to 177.07 (prices more than doubled). During that same time period, gold prices fell from over $2400 / ounce to $364 / ounce. Gold has virtually no correlation to the rate of inflation.

Is there ANY reason to buy gold?

Every dollar you spend buying gold dilutes your ability to buy assets that increase in value over time to provide a hedge against inflation.

F.U.D. – Fear, Uncertainty, and Doubt:

The demand for gold can be driven by the FUD factor.

People buy gold because they fear a collapse in the currency system and they want a fail-safe that can be traded even after a countries currency system has fallen. If that happens in the U.S., you will have more problems than those related to your investment portfolio.

I really cannot recommend purchasing gold as a portion of a growth portfolio.